For graduates who took out tuition fee loans from September 2012 onwards, you’re about to save a significant sum of money. The government has increased the threshold of student loan repayments, meaning that you now don’t a have to pay back your student loan until you earn £25,000.

Having previously been frozen at £21,000 until 2020-21, which was met with backlash because it usually rises slightly each year, the new scheme means that those who were earning £21,000 will now not have to pay until they earn £25,000. Those earning over 25,000 will also see less of their salary taken for repayments.

According to the Department for education, around 600,000 graduates will benefit from the change over the next financial year, with some saving up to £360 a year. Laura van der Erve, an economist at the Institute for Fiscal Studies told the BBC that ‘repayments will fall by around £10,000 for the average graduate’ over the course of their lifetime, thanks to the threshold increase. However, this will of course mean that the long-run cost of the government providing higher education will be increased.

While lower-income earners are the least affected by the change, since they are already below the threshold and so not paying anything back, it serves as a relief for under-18’s wary of entering higher education because of the debt.

Nevertheless, it is worth noting that this is for tuition fees only, not maintenance loans, and so students from the lowest income families will still accumulate much more debt than those from higher income families who can afford to supplement living costs.

Amatey Doku, NUS vice-president for higher education, told the BBC that while the change will be a ‘welcome relief for many of the lowest-earning graduates’, it ‘will not change the fact that our maintenance model is fundamentally regressive - students from the lowest income families accrue £57,000 of debt, compared to £42,000 for their more privileged peers.’

However, it does provide hope that the government is committed to supporting students, alongside the year-long review of tuition fees launched back in February. It aims to address the fact that England is one of the most expensive systems of university tuition in the world.

It is therefore important that this policy does not impede further conversations around helping under-18’s get into higher education, especially those from low-income backgrounds. Doku continued:

‘In making this change, the government has at least acknowledged that there are serious flaws in how we fund higher education in this country.

‘I hope that this will not preclude a more in-depth consideration as part of the upcoming review into post-18 funding, lest this becomes patching up the holes on a sinking ship’.

If you’re now wondering what you need to do to ensure you’re not paying back more than you should, you can relax! Graduates living in the UK don’t have to do anything to receive the saving as repayments are automatically calculated by employers or HM Revenue and Customs.

For those with a pre-2012 loan, repayment thresholds will also rise, although only in line with inflation, and so will rise to £18,330 from £17,775 this year.

Click through to see the top money saving tips for students

Top money saving tips for students

1 of 7

1 of 7riverisland

2 of 7

2 of 7nuscard

3 of 7

3 of 7bursary

4 of 7

4 of 7bulkbuy

5 of 7

5 of 7cooking

6 of 7

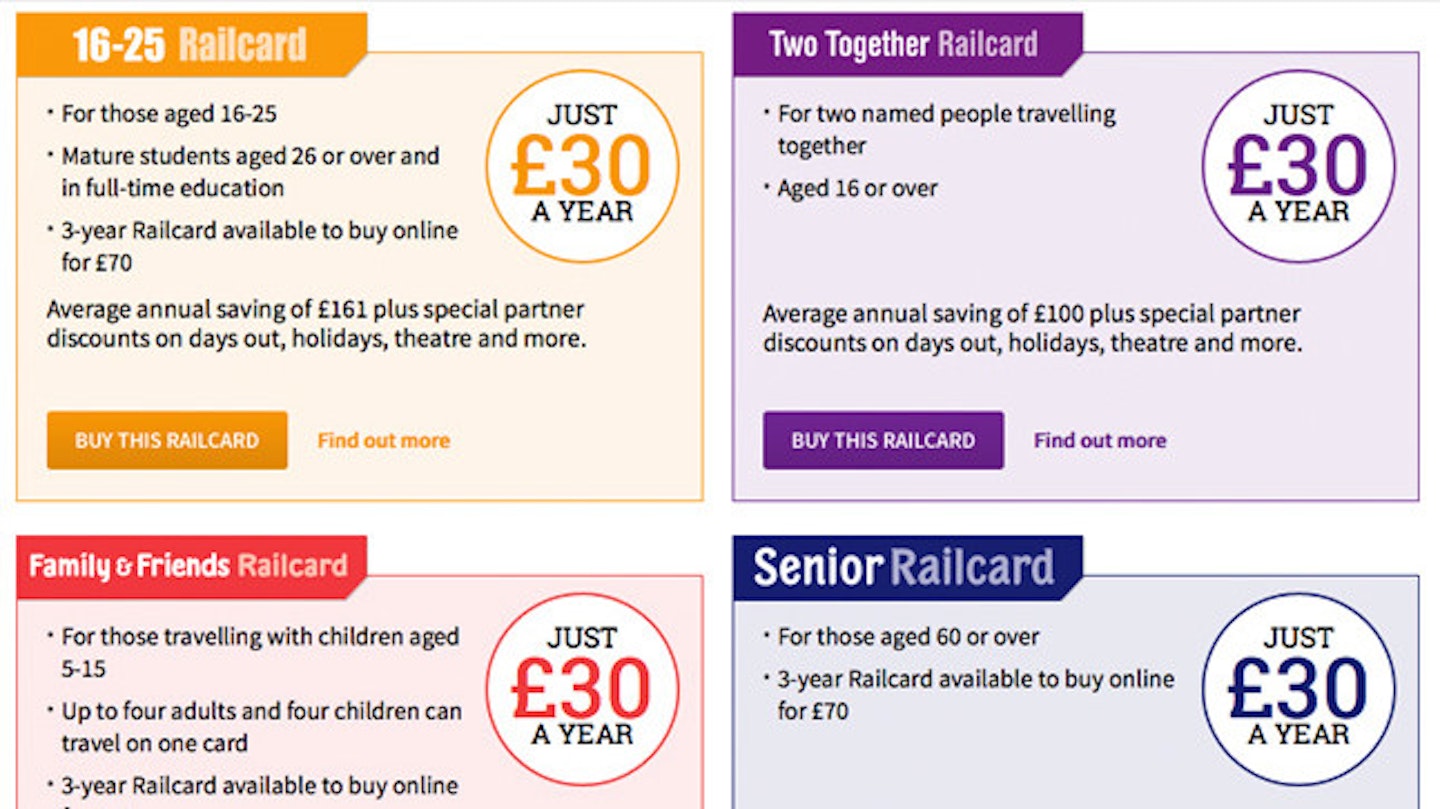

6 of 7railcard

7 of 7

7 of 7dentist

This article originally appeared on The Debrief.