How much did you shell out for the deposit on your rented home? Did you wince when you found out how much it was? How much did they ask you to put down? £500? £1,000? £2,000? How did you pay it? Did you have the cash floating around or did you borrow from friends, family or a bank?

Last year, the average amount paid by tenants in England and Wales was £967.84 and that, of course, is before you factor in the agency fees (the ban of which has not yet come into force).

Studies have found that private renters today are not only getting into debt to pay for agency fees and deposit but their rent itself too. With that in mind, surely, it’s time to overhaul the deposit system?

That is exactly what the lobby group Generation Rent are proposing. In a report released today, they say that renters in England and Wales are missing out on £80 million a year in interest on tenancy deposits. Yes, you read that right.

As things stand Generation Rent say that more than £4 billion of private renters’ money is currently sitting in protected government-accredited tenancy deposit protection schemes. However, only 2% of renters actually gain any interest on their money despite the fact that the government says that these schemes should distribute any returns to them.

**READ MORE: The Debrief Investigates - Hormonal Contraception And Mental Health **

Debrief Mad About The Pill Stats

1 of 9

1 of 9Debrief Mad About The Pill Stats

2 of 9

2 of 9Debrief Mad About The Pill Stats

3 of 9

3 of 9Debrief Mad About The Pill Stats

4 of 9

4 of 9Debrief Mad About The Pill Stats

5 of 9

5 of 9Debrief Mad About The Pill Stats

6 of 9

6 of 9Debrief Mad About The Pill Stats

7 of 9

7 of 9Debrief Mad About The Pill Stats

8 of 9

8 of 9Debrief Mad About The Pill Stats

9 of 9

9 of 9Debrief Mad About The Pill Stats

Generation Rent submitted Freedom of Information requests to the Ministry of Housing which revealed that not only are renters not reaping the interest rewards of their deposits, landlords and letting agents are actually helping themselves to it. Indeed, more than this, Generation Rent’s say that the data they’ve seen suggests that some letting agents are even using the deposit protection system to effectively borrow money.

‘Data from the Ministry of Housing reveals that 59% of deposits are protected by insurance-based schemes, where agents can hold onto the cash in return for an insurance premium of as low as £9.50 per tenancy. The average deposit held this way is worth £1240’ says Generation Rent. The other 41% of deposits, they say, are held in ‘custodial protection schemes’.

As of 31 March 2017, Generation Rent found out that £4.02 billion was protected across all of the scheme. In their new report, written in conjunction with UCL’s Dr Mike Seiferling, they estimate that it costs £18 million to operate the schemes each year. This means that if the deposits accrued interest at 2.5% - the rate on Barclays’ Help to Buy ISA – it would be worth £100 million in interest alone, of which £82m could be passed on to tenants.

Generation Rent want to see the current system of insurance-based deposit protection schemes abolished. In its place, they would like to see Personal Tenant Accounts which would make things much easier for renters. Such accounts, Generation Rent say, could allow renters to transfer their deposit over to a new tenancy once they had paid their final month’s rent in the property they were leaving. This would be a huge relief to renters and solve the problem of needing to borrow money for a new deposit. They’re calling this ‘passporting’ and say it could reduce the upfront cost of moving by an average of £786.

**WATCH NOW: Your Student Loan Explained **

Someone who knows all too well what a difference this would make to them is Daisy Rudd, a student from Newcastle. She moved into her student house with friends. She was able to borrow money from her parents to pay the £400 deposit which she paid back once she received her student loan. However, her friends were not so fortunate. ‘Some of my housemates didn’t have that option’ she says, ‘they had to borrow some money from friends and grandparents or get into their overdrafts’.

When Daisy and her housemates moved out they got caught in a long and arduous dispute with their landlord who claimed they had trashed the place, ‘it was a mess when we moved in’ Daisy says ‘I wish we had known to take photographs of the disgusting state of it but we were naïve’. This saw them loosing £100 each which, she says ‘is a problem when you’ve got someone to pay back or an overdraft to pay off for borrowing the deposit money in the first place’. Among the things her landlord tried to charge Daisy and her friends for was ‘£120 for rearranging furniture that we had moved around’.

Similarly, Lizzy who is 29 and was a long-term renter in Peterborough says ‘moving is always so expensive. There’s a lot of stages involved and you rack up so many expenses. You always expect to get the deposit back at the end of it and you actually need it in order to move’.

2 years ago, Lizzy had a landlord who tried to keep the lion’s share of her deposit because of ‘black mould’ which, she says, was so bad that ‘her cats developed asthma’. Lizzy tried to report the problem to the landlord ‘over and over’ but he ‘did nothing until we moved out and then he tried to charge us for it’.

And so, while ‘passporting’ as suggested by Generation Rent would undoubtedly make things much easier and more secure for renters, the problem of whether landlord will still try to hold onto as much of the money as possible remains.

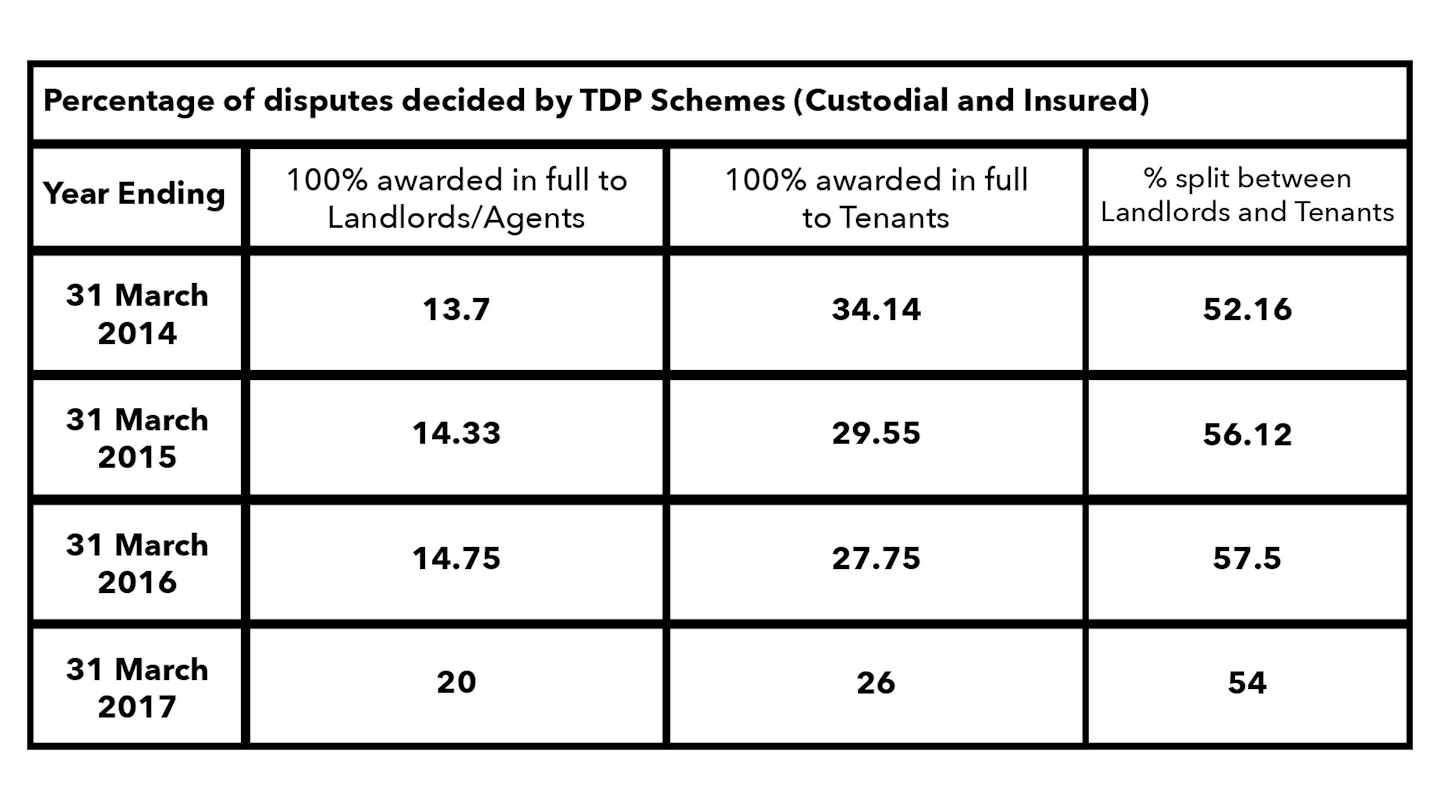

The Debrief can exclusively reveal that a Freedom of Information request submitted to the Ministry of Housing shows that the number of renters whose deposit disputed escalated to adjudication was 31,029 in 2017 (up from 27,830 in 2016). Of these, 54% were split between the landlord and the tenant, 20% were awarded solely to the landlord and 26% were awarded solely to the tenant.

However, not all renters go through to adjudication because as Lizzy says you ‘have to submit loads of evidence…the forms are long and complicated’. So complicated in fact, she notes, that her landlord never actually filled them out meaning that the dispute went in her favour. The point, however, is that if English wasn’t your first language or you weren’t computer literate the dispute procedure would be very difficult to navigate and could mean you lose out.

Last summer I lost nearly my half of a £2,914 deposit when I moved out of a rented flat. The landlord submitted receipts for work which were essentially pieces of paper with numbers scrawled on them. He tried to charge me £60 for a ‘loose toilet seat’ which was very much still attached when I left but, because I didn’t anticipate him trying to claim for a problem that didn’t exist, I didn’t have a close-up photograph to prove that he was lying. The adjudicator sided with the landlord. Similarly, like Lizzy, I had tried to flag a ventilation problem in the flat which was causing black dust to gather on the walls. Not once did the landlord accept my invitations to view the problem. When I moved out, he tried to charge me and claimed I had caused the problem. Again, the adjudicator sided with the landlord despite the fact I could prove that I had emailed repeatedly about the issue.

The ‘passporting’ of deposits is a good start, next up we need reform of the dispute process. As things stand, even seemingly simple things like how to define ‘reasonable wear and tear’ are open to interpretation. Solicitors Reed Rains point out that ‘confusion over the term exists quite simply because what is ‘reasonable’ and ‘ordinary’ is subjective’, allowing landlords to argue that a tenant has caused damage when, in fact, it may be that the condition of a property has merely declined in a ‘normal’ way.

And therein lies the rub. Generation Rent’s ‘passporting’ proposal is undoubtedly a good start on the much-needed reform of the tenancy deposit system. However, the next challenge will be coming up with reforms which would ensure fairness and transparency when it comes to how deductions are settled at the end of a tenancy.

Imagine a world where you could get most of your deposit money back before the end of your tenancy? You could secure a new place to live without having to dip into your savings or get into debt to get a new deposit together. This, Dan Wilson Craw of Generation Rent told *The Debrief *this would mean that ‘by the time any dispute was raised [renters] would be more financially resilient and therefore more willing to fight any landlord claims’ against them.

Follow Vicky on Twitter @Victoria_Spratt

This article originally appeared on The Debrief.