It’s no secret that there’s a generational wealth divide in this country. Behind the hyperbolic headlines about house prices and lazy millennials, it’s true that young people are less likely to own their own home than older generations, more likely to earn less than their parents did at the same age (relatively speaking) and more likely to be in unstable or part time work. This is the case across Europe, not just in Britain.

These economic trends are more than just a demoralising cloud that hangs over young people, giving us all an excuse to feel sorry for ourselves - they have serious implications for the future of our country.

One man who has, or thinks he has, the answer is former Conservative minister David Willetts. In a major speech today, Lord Willetts will warn that baby boomers must pay for the increasing costs of social care or risk imposing crippling tax hikes on younger generations - their children and grandchildren.

Lord Willetts, who is also chair of the Resolution Foundation, is due to give a speech in which he will say ‘the time has come when we boomers are going to have to reach into our own pockets. The alternative could be an extra 15p on the basic rate of tax, paid largely by our kids’.

In the speech, Willetts will also ask‘is that kind of tax really the legacy we – a generation who own half the nation’s wealth – want to bequeath to our children and grandchildren?’. He will then say ‘this is the moment when the chickens come home to roost for all of us, but the baby boomers in particular.’

This suggestion is actually rather radical – imagine if income tax bands were set out not only by the amount you earn but by age too.

Lord Willetts is arguing that the cost of caring for our ageing population and further failure to make decisions about how we fund this, will further cause the social contract between our nation’s old and young people to fray. There can be no doubt that this has already started to happen; the moment that the established life trajectory of education, followed by stable employment and then owning your own stable home became unattainable for younger people that social contract began to break down.

‘By the end of the next decade, the fiscal gap is set to grow to the equivalent today of £20bn a year and then to £60bn after another decade. That translates to an income tax hike of 15p in the basic rate by 2040, the burden of which will overwhelmingly fall on the generations following baby boomers’, Willetts will say.

If younger people’s take-home pay is reduced because of tax increases which will go towards funding the rising cost of healthcare, this would only further rub salt into the wound. ‘As we baby boomers sit on so much wealth – which has continued to grow as incomes have stagnated – one obvious source is for us to make a contribution through capital or property taxes’ Lord Willetts will argue in his speech about intergenerational fairness.

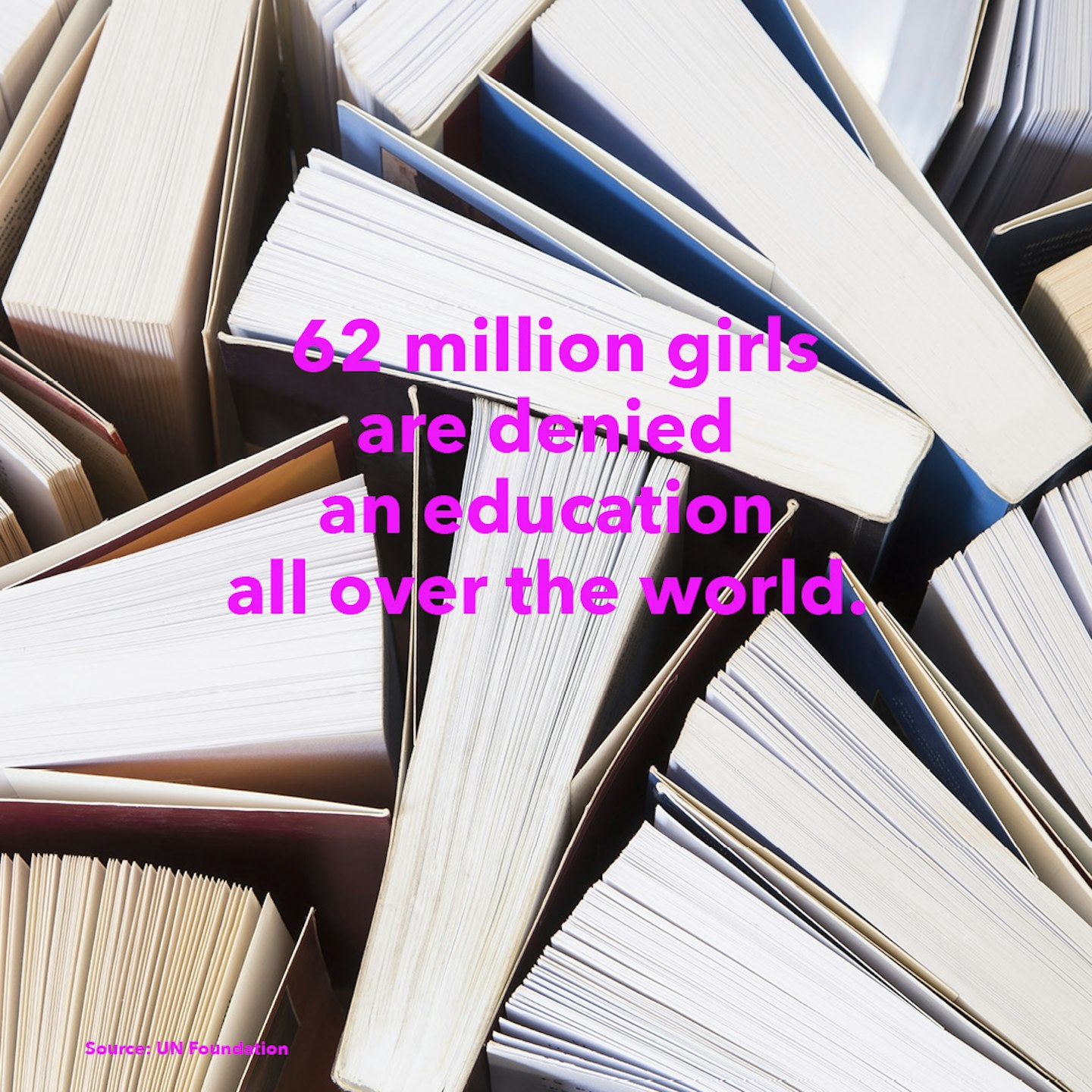

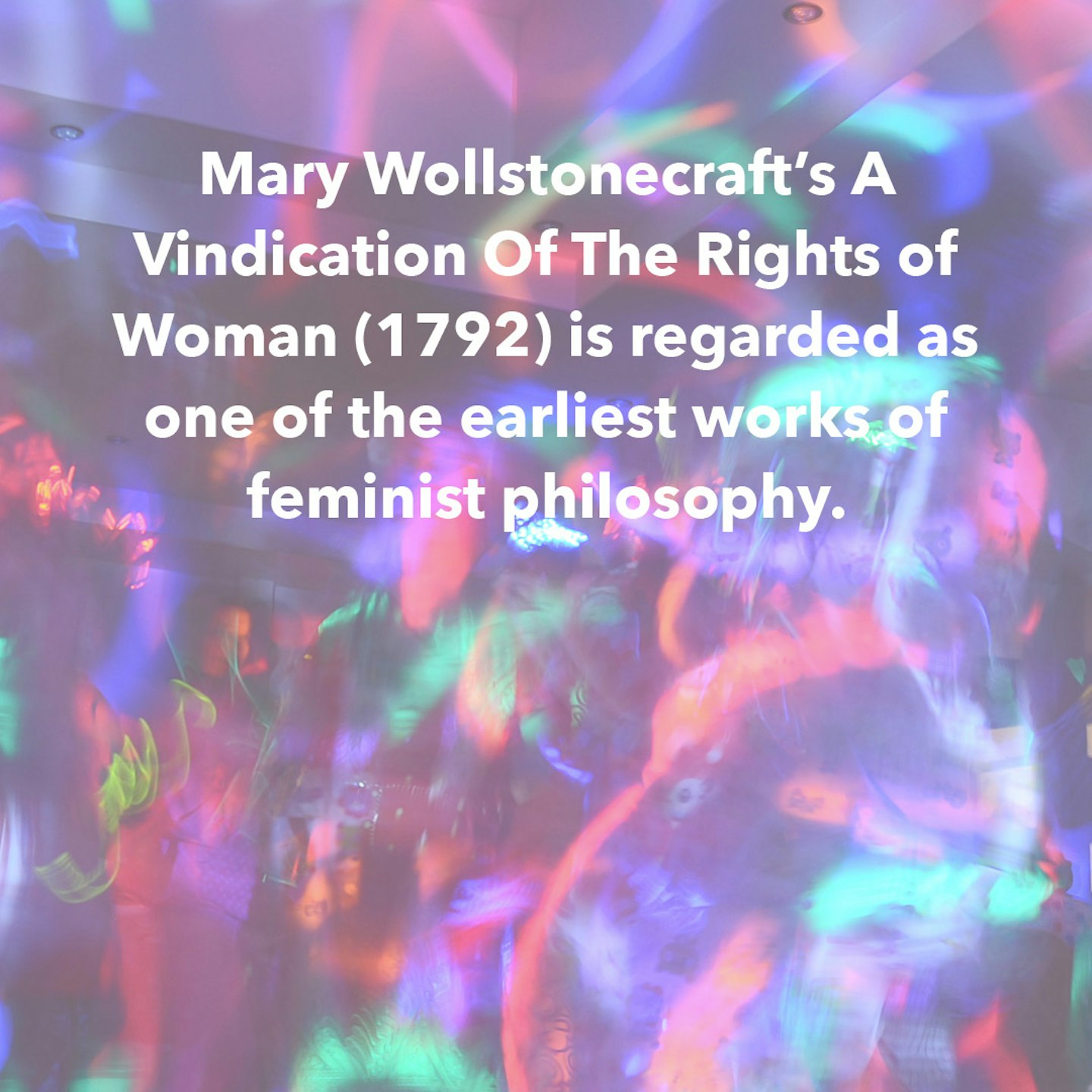

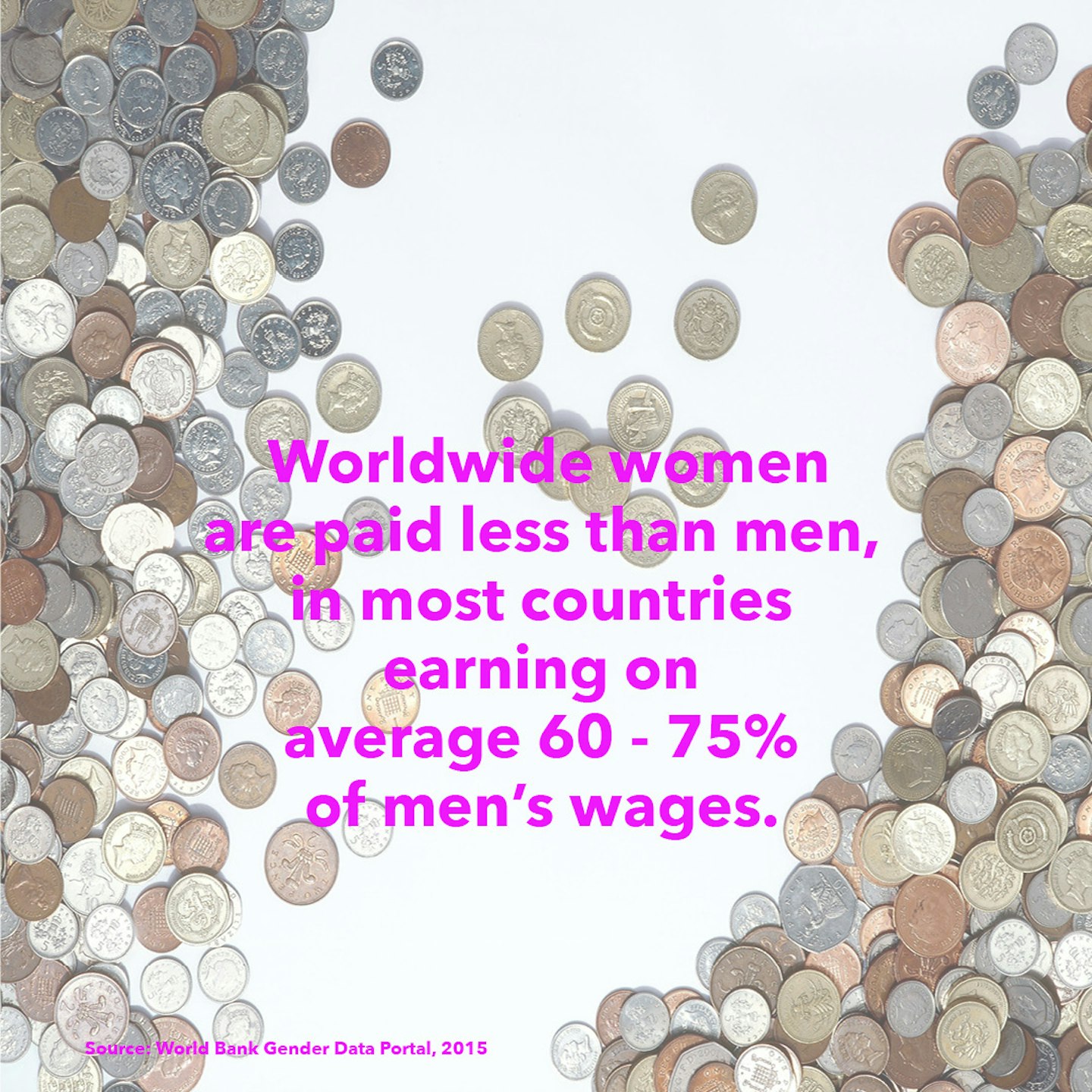

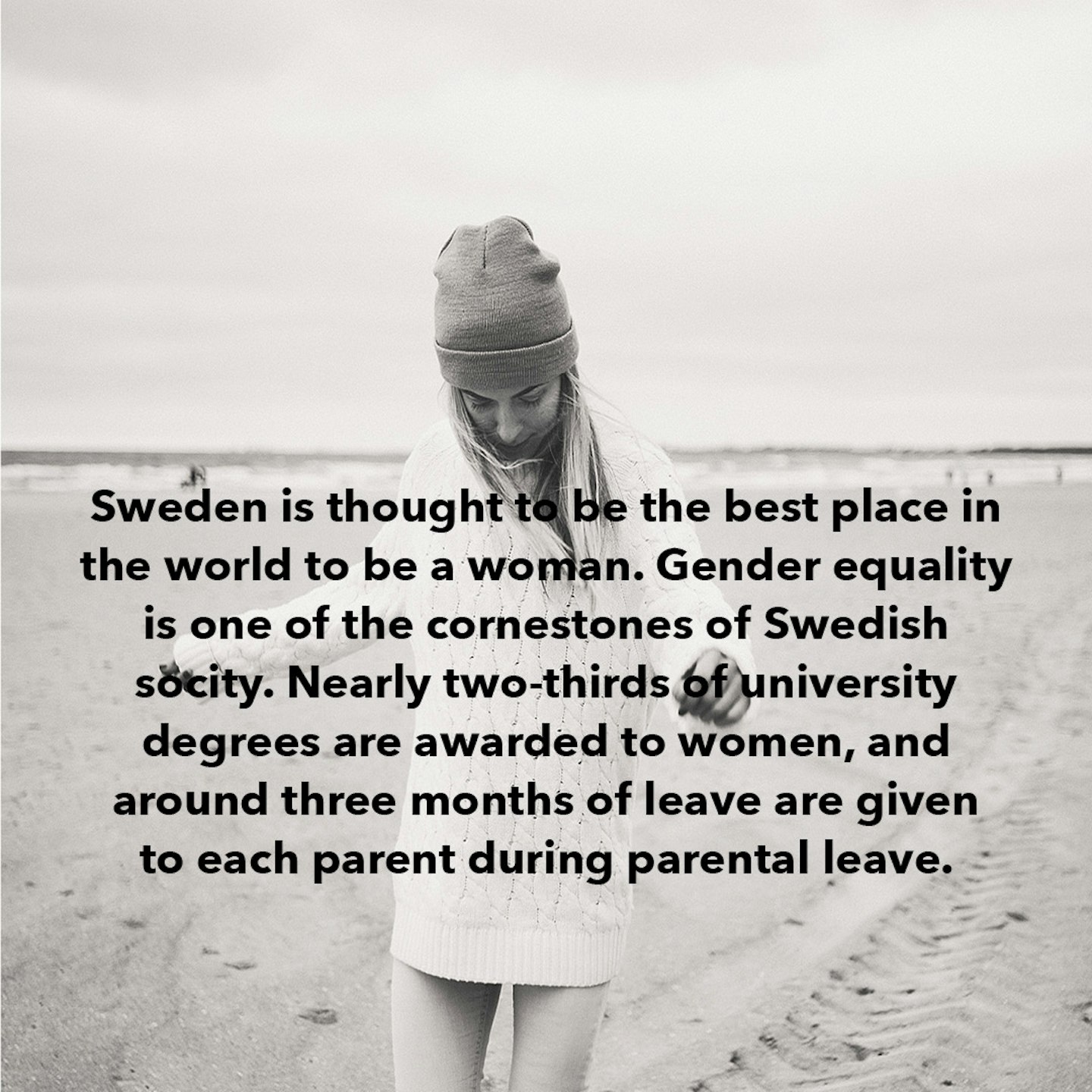

**READ MORE: Facts About Women Around The World **

Debrief Facts about women around the world

1 of 18

1 of 18Facts about women around the world

2 of 18

2 of 18Facts about women around the world

3 of 18

3 of 18Facts about women around the world

4 of 18

4 of 18Facts about women around the world

5 of 18

5 of 18Facts about women around the world

6 of 18

6 of 18Facts about women around the world

7 of 18

7 of 18Facts about women around the world

8 of 18

8 of 18Facts about women around the world

9 of 18

9 of 18Facts about women around the world

10 of 18

10 of 18Facts about women around the world

11 of 18

11 of 18Facts about women around the world

12 of 18

12 of 18Facts about women around the world

13 of 18

13 of 18Facts about women around the world

14 of 18

14 of 18Facts about women around the world

15 of 18

15 of 18Facts about women around the world

16 of 18

16 of 18Facts about women around the world

17 of 18

17 of 18Facts about women around the world

18 of 18

18 of 18Facts about women around the world

If, like me, you’ve ever had a very uncomfortable conversation with your grandparents about the value of their home and explained to them that you just can’t afford to buy one of your own, you’ll know that the proposals Willetts is putting forward will not be popular with older generations.

However, something will have to be done. For a long time both the left and the right have tiptoed around generational inequality – it is the political elephant in the room because both the Conservatives and the Labour Party know that they do need older people’s votes in order to win elections. Remember the unpopular so-called ‘Dementia Tax’ floated by Theresa May’s party during the last election? Or the doomed-to-fail Lib Dem ‘mansion tax’?

Cutting stamp duty for first time buyers or pumping funding into Help to Buy makes for good headlines but, in reality, this is just tinkering around the edges and does little to solve the problem of generational wealth inequality long term.

‘The younger generation are spending a record share of their income on housing – and getting smaller, insecure rented accommodation in return, rather than the homes they want to own and settle down in’ Willets will add in his speech, ‘the norm of major living standards gains made by each successive postwar generation is under threat’.

Could a wealth tax for older generations ever become a reality? It’s hard to imagine and politically difficult for either party to take on but certainly not impossible. Without it we could see taxes rising which, as Torsten Bell the Resolution Foundation’s director has previously warned, could mean less ‘public support’ for ‘and major cuts to the welfare state which previous generations of social democrats have fought so hard for.’

Follow Vicky on Twitter @Victoria_Spratt

This article originally appeared on The Debrief.